Auto suppliers "freaked out" by China backlash, potential impact on consumers

Supply chain threat worse than COVID with 77% "pessimistic" for 2025

Auto executives and their suppliers have been meeting for weeks behind closed doors to discuss privately the looming threat of disruption to the global supply chain, including a potential production shutdown, created by President Trump’s trade war against China, Shifting Gears has learned.

“Suppliers are ‘very freaked out,’” said a global auto industry executive who revealed the confidential talks on the condition that the company not be disclosed. “China doesn’t need to scream and shout when they know they can step on our air hose.”

Automakers and consumers learned during the COVID-19 pandemic the impact of supply chain disruption, forcing production delays that require long-term storage that actually reduce the quality of vehicles held for the arrival of final parts.

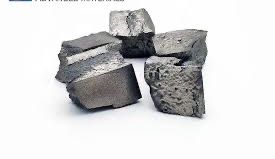

One of the biggest concerns dominating private talks is supplier access to rare earth elements provided almost exclusively by China, which China suspended in April as retaliation to Trump’s threats and tariffs.

“China has cornered the market on rare earth content, and it goes into everything,” said the auto industry executive, who revealed proprietary data shows some suppliers predict a supply chain crisis beginning as soon as mid-May.

Rare earth elements are used in automotive glass, LED lights, mirrors and sensors. Magnets throughout cars are used to operate windshield wipers, fuel pumps, seatbelts, anti-lock braking, transmission systems, power steering, speakers and oil filters. For example, magnets can help filter metal dust.

An industry executive told Shifting Gears that anyone familiar with the private supplier talks actually recognized “code” language on May 5 during Ford Motor Company’s first quarter earnings discussion with analysts.

The exchange was brief but significant, the executive said.

Adam Jonas, an analyst from Morgan Stanley, said, “I’m asking very bluntly, are you seeing any signs of distress or disruption of supply chains following the volatility, the implementation of the import tariffs to date?”

Kumar Galhotra, Ford chief operating officer, replied, “There’s been so much volatility in the tariff policy, so that could cause disruption … The rare earth materials from China, for example, how they are imported, not just for us but for the entire industry … has become rather complicated over the last few weeks. It would take only a few parts to potentially cause some disruption into our production.”

While both Ford and General Motors beat Wall Street expectations for first quarter earnings, Ford revealed a $2.5 billion impact from tariffs while GM disclosed a $4 billion to $5 billion impact from tariffs. Ford suspended its 2025 financial guidance.

“One of the reasons Ford pulled guidance is because of the potential for supply chain disruption,” a source with personal knowledge of the situation told Shifting Gears. “So far, mineral access hasn't disrupted production. We believe it will. It’s a lot of U.S. suppliers affected. This could be a serious problem. And industry people in key positions continue talking in code.”

That “code” refers to rare earth elements. But more detail on that later.

Trump starts to fold when China doesn’t

Meanwhile, members of the Trump Administration — which instigated the trade war with China — now says it’s unsustainable.

Trade Secretary Scott Bessent told Fox News on Tuesday, May 6, “ … you know, 145% (tariffs), 125%, is the equivalent of an embargo. We don’t want to decouple, what we want is fair trade.”

Talks scheduled for this weekend in Switzerland, initiated by the U.S., will likely focus on “de-escalation,” Bessent said. “We’ve got to de-escalate before we can move forward.”

Trump ratcheted up tariffs in April to 145% on imports from China, one of America’s largest trading partners. And China retaliated. President Trump posted on Friday, May 9 at 7:26 a.m. on Truth Social, “80% Tariff on China seems right! Up to Scott B.”

‘Tremendous uncertainty’ without end

Trump’s lack of clear direction continues to paralyze the auto industry.

Nearly five months after his inauguration, executives say they still don’t know what to expect.

Key decisions and investments remain on hold pending policy clarity.

“We didn’t have any more clarity,” said Mike Jackson, executive director of strategy and research for the Motor and Equipment Manufacturers Association (MEMA), a trade group representing more than 1,000 companies that make vehicle components.

“There’s tremendous uncertainty,” he said. “And the industry can’t turn on a dime.”

Changing supply chains, including rare earths, takes years, Jamie Dimon, CEO of JPMorgan Chase, told Fox News on Wednesday, April 7. And the tariffs were “beyond what people expected,” he said.

Pessimism grows among business leaders

A recent vehicle supplier survey known as a first quarter barometer — conducted by the trade group in partnership with Deloitte and released April 3 — depicted a business outlook that has “deteriorated” since the end of 2024:

The 12-month outlook grew more pessimistic during first quarter of this year among 77% of the suppliers of all sizes surveyed, up from 57% a year ago.

The greatest threat to the industry was identified as trade policy.

Suppliers see the current threat to the supply chain as worse than the pandemic in 2020 but not quite as bad as the Great Recession between 2007-2009.

The role of rare earth elements processed in China is significant to the global supply chain and “all it takes is one component” to bring vehicle production to a standstill, Jackson said.

“The administration has clearly stated their objective of bolstering manufacturing in the U.S.,” he said. “We support that objective, while we don’t support tariffs given the fact that it creates a lot of uncertainty, pressure and cost.”

This is what Galhotra was alluding to during the Ford first quarter earnings call.

Why China holds all the cards

Wall Street analysts know what’s at stake.

They’re monitoring trade talks this weekend closely.

Trump hasn’t spotlighted the issue of rare earth elements.

But it’s big, really big.

What happened: “On April 4, China’s Ministry of Commerce imposed export restrictions on seven rare earth elements (REEs) and magnets used in the defense, energy, and automotive sectors in response to U.S. President Donald Trump’s tariff increases on Chinese products,” according to a report last month from The Center for Strategic and International Studies, a bipartisan, nonprofit policy research organization dedicated to advancing ideas to address world challenges. “The new (Chinese) restrictions apply to 7 of 17 REEs—samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium …”

Where the U.S. stands currently: There is no heavy rare earths separation in the U.S. currently though plans are underway. “In its 2024 National Defense Industrial Strategy, the Department of Defense (DOD) set a goal to develop a complete mine-to-magnet REE supply chain that can meet all U.S. defense needs by 2027. Since 2020, the DOD has committed over $439 million toward building domestic supply chains,” The Center for Strategic and International Studies wrote.

‘Enemy’ talk has consequences

Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions based in Chester Springs, Pennsylvania, said, “When you need to rely on China and China is now portrayed as the enemy, it’s very difficult to move forward with your business. It will disrupt all kind of parts and systems that the public is absolutely not aware of — but the government may not be aware of, either.”

Discussion of current public policy sounds like a Chemistry 101 class.

But it’s essential for taxpayers and consumers to understand.

For example, samarium is found in small magnets used in motors, speakers and lasers; dysprosium is used in motors, lighting and lasers.

“Any electric switch, motor, all these things use magnets. Magnets are all over the vehicle and have been before the modern digital vehicle,” Fiorani said. “Because they’re called ‘rare earth,’ everyone thinks they’re gold or diamonds — neither of which is really rare. It’s found in small quantities and it takes a lot of processing to use it. So you have countries like China, which has lax standards for worker safety and environmental safety, that can make it at a reasonable price. When you move the process to the U.S. or Canada or Australia, it would be much more expensive.”

These rare earth elements are used in small quantifies in a lot of products, and that’s why so many suppliers are so worried.

“While each company many need only a couple grams of a product, there are millions of those items made for each car,” Fiorani said. “China is the main resource for a lot of these products because of how it’s processed. And it’s a lot cheaper.”

Outsourcing to China has helped companies contain costs and maximize profits, but it comes with risk, said Julie Klinger, associate professor of geography and spatial sciences at the University of Delaware.

Auto industry executives say privately that they worry President Trump may not understand the depth of the threat, which could mimic the global semiconductor chip shortage that ran from 2020 to 2023 and directly impacted tech and auto.

Editor’s note: Phoebe Wall Howard is an award-winning autos reporter who specialized in supply chain and metals coverage at The Detroit Free Press. She left the newspaper in 2024.

More: Trump stronghold in Michigan is anxious

More: Canadian sailors redesign race course, avoid U.S. waters for "safety”

PS: As a proud member of the Iowa Writers’ Collaborative, a roundup of world-class journalists, I hope you’ll check out the incredible news, commentary and features

Very illuminating, thanks. Also helps explain why newer vehicles are so expensive.

This is really valuable reporting, Phoebe. It's becoming clearer why Trump wants to annex Canada and Greenland -- for their rare earth minerals, leaving us conceivably less dependent on China.

Hard pass for me.